Buying a pre-construction condo can be exciting, but when it comes to the financial aspects of it, most people are in the dark, which can lead to disappointment in the end. The problem is, buyers tend to only look at the deposit and mortgage payments when analyzing a potential property. Unfortunately, those fees are just the tip of the iceberg. What you should also consider are the other fees that go with purchasing a condo, which can be comprised of a mix of maintenance fees, utilities, and property taxes and closing costs. Closing costs can include everything from warranty fees, land transfer taxes, legal fees, and admin fees, but one of the most important, yet overlooked fees are called “Development Charges / Levies”.

Unfortunately, development charges often catch buyers by surprise. The last thing you want is to be sitting at the closing table looking at a development levy fee of $25,000 just because you failed to understand exactly what it was. Now you’re forced to eat instant noodles every day. If you don’t want to eat instant noodles or any kind of instant anything, then you will want to read this.

What Exactly are Development Charges / Levies?

Development Charges / Levies are essentially a tax issued to a condo developer from the city when the developer receives their building permit. Condo developers are required to pay these levies to municipalities in order to help fund city infrastructure. They fund everything from roads, parks, libraries, police, and education. The four main development charges are Green standard levies, Education levies, General Levies, and Section 37 levies.

No question about it, these fees can certainly add up, but the reason they are charged is that the city needs money to maintain all the infrastructure needed to serve all the new residents of the newly built condo in the form of improvements to transit, roads, hospitals, and schools. The city spreads the costs out by the total square footage of the proposed building and the developer pays by the unit, so depending on the size of the unit you buy, those fees might be passed on to you.

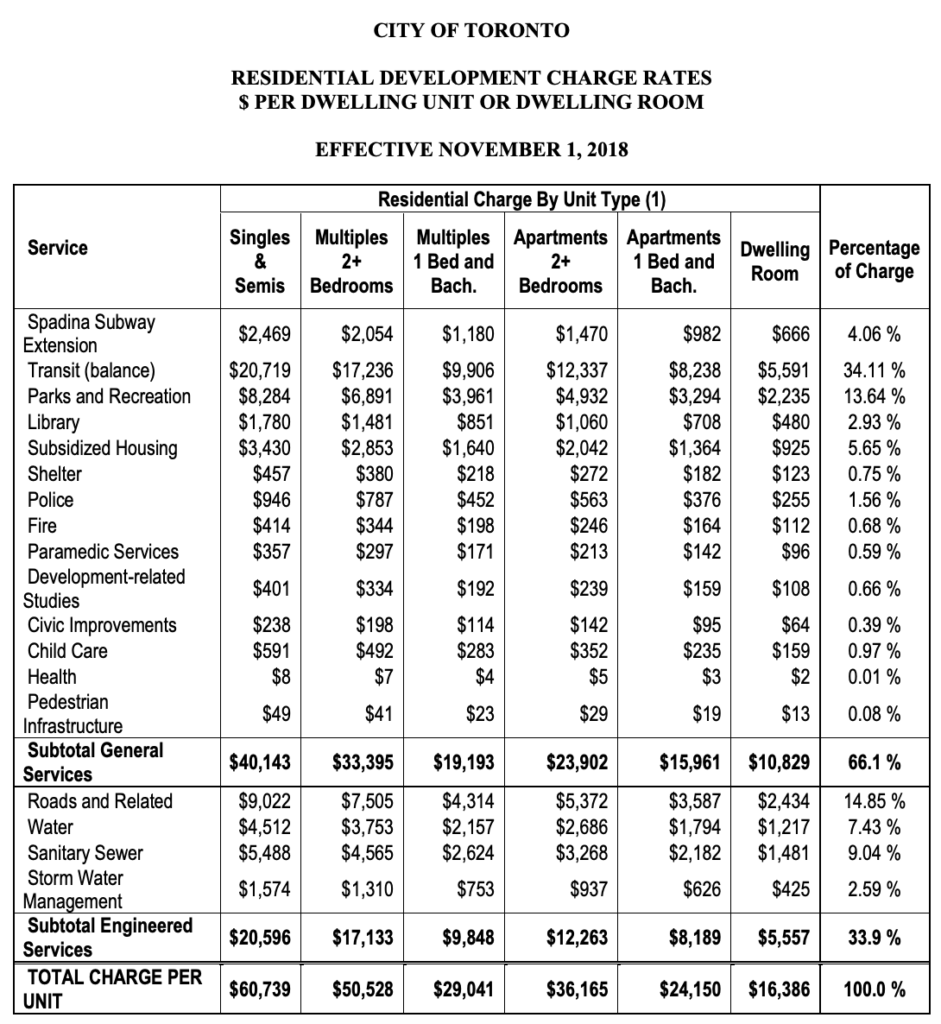

Here’s an example of residential development charges according to unit types in the City of Toronto:

Now, you might be asking yourself, if the city is charging the development charges / levies to the developer, then why do I have to pay for it? The reason is, even though the developer is issued the fees, they are able to pass those costs onto you because you will be inevitably be using the infrastructure, so why not?! Since this fee is something you cannot avoid, one of the most important things you can do before signing a contract is to negotiate the additions of a clause in your agreement that “caps” those levy charges to limit the amount that you pay at closing.

You might see something advertised online that offers “Development Charges capped at $10,000.” What that means is that if the total development charges are $20,000, then you are only responsible for paying $10,000 while the developer pays the other $10,000.

TIP: When you’re purchasing a pre-construction condo from a developer, make sure you find out how they are managing the levies. Are they being added at closing or are they included in the purchase price? Always have a lawyer review your Agreement of Purchase and Sale and any disclosures included in the contract to know exactly how the levies are being paid.

What You Can Do to Limit Development Charges / Levies

If you don’t want to end up surprised at the closing table because you have to pay development charges as part of your closing costs, then you can do one of two things…

- Plan Ahead. Make sure you have a good understanding of the approximate amount you will be responsible for at closing and then save money to pay it.

- Negotiate to cap your fees. Before you sign your agreement, have your Realtor (hopefully me!) negotiate to cap your development charges. Don’t be shy about asking! This can literally save you thousands of dollars.

Do you need help understanding Development Charges / Levies? If so call, text, or email me anytime!