Hack #1 – Don’t Buy a House in Toronto.

Let me explain…

In the past 10 years, average home prices in Toronto and the GTA have seen a meteoric rise resulting in an affordability crisis for younger buyers who likely may never be able to afford a home. To give you an example of what young millennial buyers are currently facing, In 2022, the average price for a detached home in Toronto is now over $1.5 million and condo prices are not too far behind, hovering above $700,000. Compare that to 2012 when average prices for a detached home were available for only $570,000 or condos for $330,000 (If I had a flux capacitor, I’d be driving 88MPH back to 2012 right now).

Unfortunately, time machines don’t exist, so if you are a young buyer who doesn’t have a higher-than-average salary or parents who can provide you down payment assistance, then the dream of owning a condo or detached home in Toronto is most likely just that, a dream.

The only thing left to do is either rent or expand your search a little further outside the GTA.

There are a lot of people for whom renting forever is not a bad thing, but with rental rates rising quickly as well, a majority would rather not rent for the rest of their lives.

So what can you do if your goal is to buy a home in Toronto?

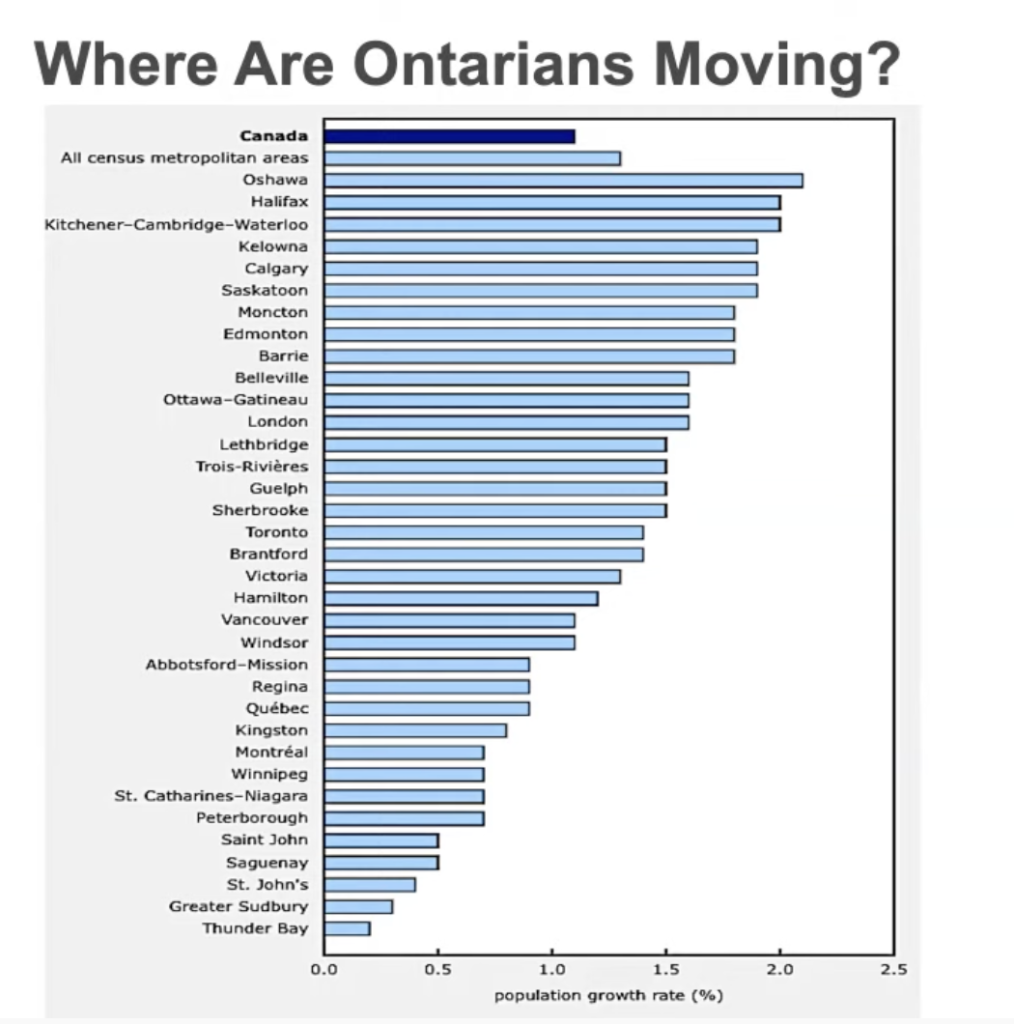

A strategy that first-time homebuyers are utilizing right now is to NOT buy a house in Toronto. Instead, they are shifting their focus away from the Toronto market and considering buying in areas in the GTA that are more affordable like Oshawa, Whitby (likely condos) or looking even further out like Kingston, Belleville, or even Halifax where prices are more affordable. Instead of focusing on areas where they can’t afford to buy right now, they are instead “Getting in where they fit in.” With this approach, the main focus is to enter the market by buying an older bungalow or condo or looking into pre-construction projects in those high-growth areas away from Toronto to build massive equity in a home quicker through price appreciation. Appreciation that can be cashed in later when the time is right to move you closer to owning in Toronto.

The question you have to ask yourself is,

“Would you rather be in debt for the rest of your life to live in Toronto, or can you see yourself moving to areas where your whole paycheck isn’t just going to pay your mortgage and perhaps look to live in Toronto at a later date?”

A certain shift in thinking has to happen for you to consider doing this. You have to look at it like buying a car – your first car won’t be your forever car, you’ll likely end up changing the car 3 or 4 times. Your first home is your entry-level home. It’s important to remember that buying a home is not a life-long commitment. You can sell at any time and move on to the next.

If you employ this strategy, you will want to remain focused on the appreciation of the home. Consider this…If you purchased a home in Barrie for $500,000 pre-pandemic (late 2019, early 2020), that same home today would now be selling for over $900,000! In 2 years, you would have made close to $400,000 in profit, which is money that you could now use towards re-entering the Toronto market. The sacrifice is that you had to live in Barrie for a couple of years, but at least your mortgage was affordable! (No offence, Barrie, but you’re cold.)

Barrie is just one example.

Let’s compare how prices have appreciated in areas outside of Toronto for both houses and condos.

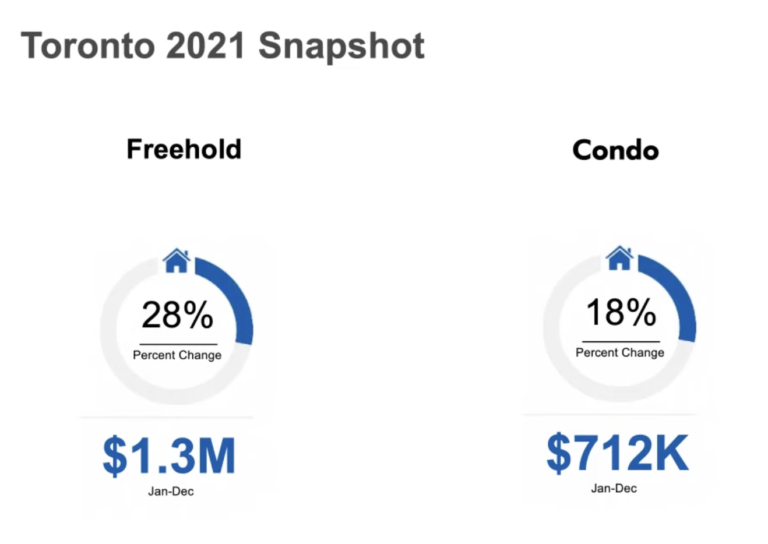

From January 2021 to December 2021, prices in Toronto skyrocketed with a 28% increase for freehold homes and an 18% increase for condos, so to enter the market in Toronto, you have to be able to afford a home with an average starting price of $1.3 million or a condo priced at around $712k. These are not entry-level prices and are what make Toronto unaffordable.

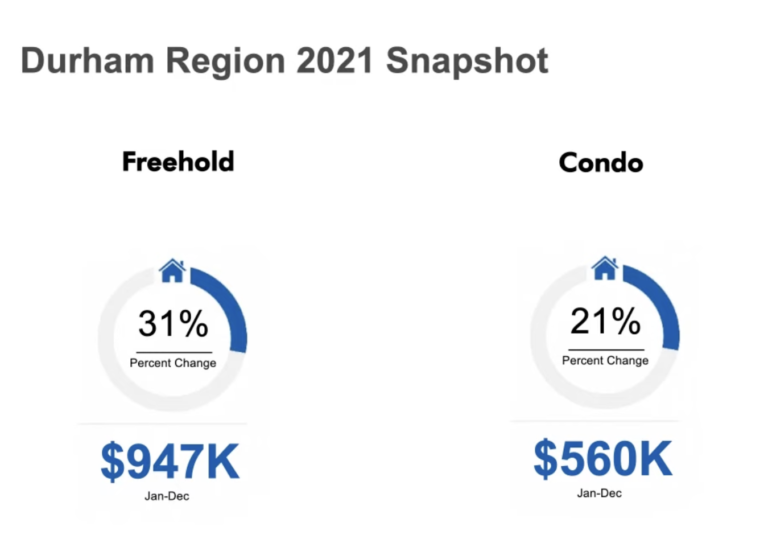

In 2021, properties in the Durham Region (Oshawa, Pickering, Clarington, Ajax, Whitby, Uxbridge, etc.) saw an increase of 31% for freeholds and a 21% increase for condos. This means that if you purchased in the Durham region in January of 2021, your home would have seen an increase of 31% by December. Imagine being able to now take that equity and use it to buy a property in Toronto?

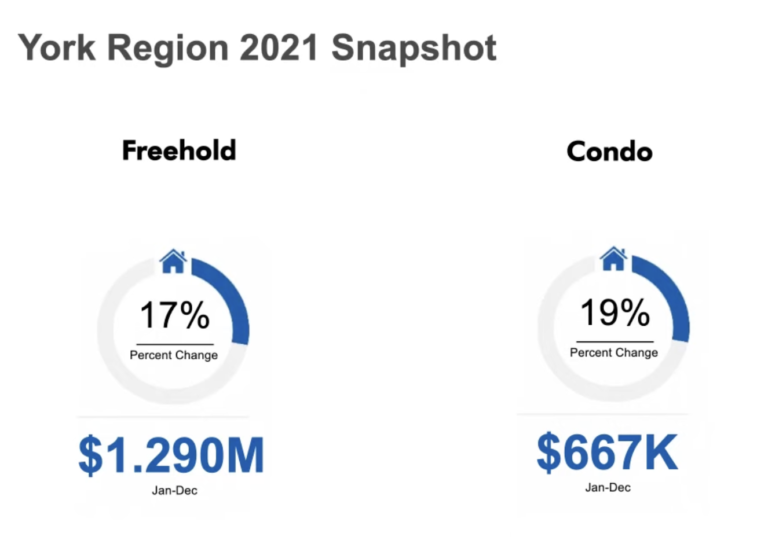

Homes in York Region (Markham, Richmond Hill, King, Vaughan, Aurora, Newmarket, Whitchurch-Stouffville, Oak Ridges, etc.) appreciated in value less than those in Toronto, but still saw a gain of 17%, while condos saw a 19% gain. With a current price point in the $667K range, the ability to purchase a condo in York Region is still an option.

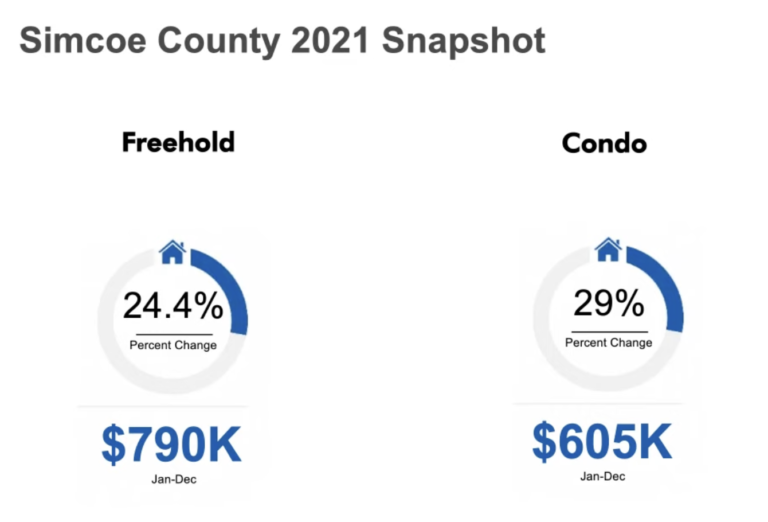

Simcoe County (Barrie, Orillia, Innisfil, Wasaga Beach, Collingwood, etc.) saw incredible price appreciation in 2021 and should continue increasing in value over time.

The important thing to understand is that the areas outside of Toronto will consistently have lower barriers of entry when it comes to home prices (especially condos), yet they are appreciate in value faster than those in Toronto. If you are serious about moving to Toronto, then maybe looking outside of Toronto first is something to consider. Don’t know where to start? Here’s a list of where people are moving to now:

As always, if you have any questions or need help putting a strategy together, please do not hesitate to ask! You can call or text me anytime.